Consultancy

Consultancy

We advise our clients comprehensively, evaluate opportunities and risks, and develop customized, sustainable strategies for direct and indirect real estate investments.

Always with a long-term focus, continuity, and risk awareness.

Analysis

Analysis

For over 30 years, we have been analysing the Swiss real estate market and its investment products.

In addition to quantitative aspects, qualitative factors such as management principles, cost discipline and the creation of long-term added value play a significant role.

Strategy

Strategy

We assess your real estate portfolio, evaluate and create holistic and sustainable strategies and support you through the implementation process.

We facilitate strategic partnerships and generate synergies for additional development and value enhancement potential.

Networking

Networking

Thanks to many years of experience and the network we have built up as a result, synergies and connections are created between property owners, investors, asset managers and service providers.

With this approach, we built bridges between direct and indirect property investments, private and institutional investors as well as between French- and German-speaking Switzerland for our clients.

Mandates

Mandates

We develop a suitable real estate strategy for you on a mandate basis.

The continuous personal dialogue ensures the ability to respond to changing preferences or market situations at any time. This can also take the form of participation in bodies such as investment committees, boards of directors or trustees.

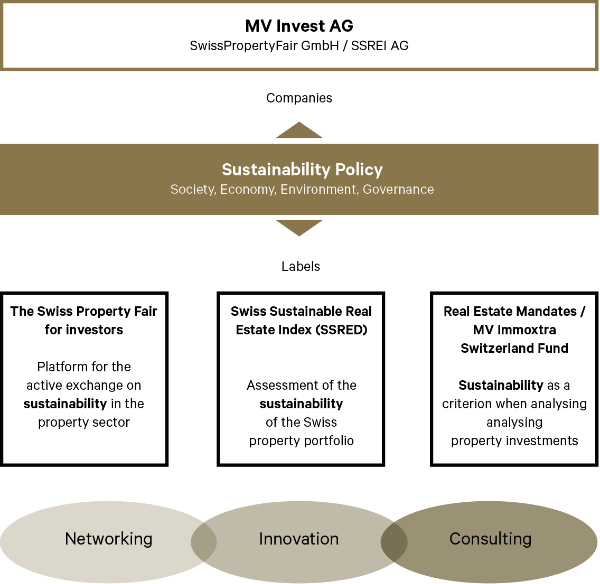

Sustainability

Sustainability

Our proprietary sustainability model allows us to evaluate all listed and non-listed Swiss real estate products (stocks, funds, investment foundations) and provide institutional investors with sustainability reporting.

With the Swiss Sustainable Real Estate Index (SSREI), a standard for assessing the sustainability of the Swiss building stock was launched as well.

Market Commentary January 2026

As every year, January is a particularly busy month for real estate investments. The IMMO26 trade fair, held in mid-January, once again provided important guidance for the coming months. In this context, political decisions remain a central topic, often characterized by contradictions. For example, more than 60% of city residents...

Market Commentary January 2026

As every year, January is a particularly busy month for real estate investments. The IMMO26 trade fair, held in mid-January, once again provided important guidance for the coming months. In this context, political decisions remain a central topic, often characterized by contradictions. For example, more than 60% of city residents complain about a housing shortage, while at the same time 50% to 70% of them oppose increased densification or the construction of high-rise buildings. Furthermore, the authorities are demanding better tenant protection, even though tenants already have the option of requesting a rent reduction due to the lowering of the reference interest rate – a right that more than 50% of tenants do not exercise. Demographic differences between the cantons are also beginning to emerge. According to MoneyPark, population aging and declining demand could pose challenges in several cantons, including Ticino, Bern, Jura, and Graubünden, in the medium term. At the macroeconomic level, the deteriorating global political environment continues to support the Swiss franc and maintain high demand for real estate, particularly from foreign investors. However, assessments of the remaining market potential diverge, particularly in relation to current stock market valuations: Morgan Stanley considers Swiss Prime Site overvalued, while UBS holds the opposite view. The market's reaction is evident in the launch of new products and capital increases, in an environment where this additional liquidity must be reinvested at already high price levels. The market entry of the Mobifonds and the planned launch in spring of a new real estate fund focused on commercial properties by Swiss Life on the SIX stock exchange are likely to have a noticeable impact on further market developments.

The Market Commentary newsletter - subscribe here!

Our team for your goals.

Expertise, passion, and anticipation lay the foundation for us to fully focus on your needs

Roland Vögele

CEO

+41 43 499 24 90

Sacha Deutsch

Senior Advisor

+41 43 499 24 91

Ulrich Kaluscha

Senior Advisor

+41 43 499 24 96

Daniel Smith

Senior Advisor

+41 43 499 24 96

Remo Burri

Investment Analyst

+41 43 499 24 94

Debora Zgraggen

Operations Manager

+41 43 499 24 97

Leonie Eberhardt

Event/Marketing Manager

+41 43 499 24 89

Elvira Bieri

Chief Sustainability Officer

+41 43 499 24 99