Consultancy

Consultancy

We advise our clients comprehensively, evaluate opportunities and risks, and develop customized, sustainable strategies for direct and indirect real estate investments.

Always with a long-term focus, continuity, and risk awareness.

Analysis

Analysis

For over 30 years, we have been analysing the Swiss real estate market and its investment products.

In addition to quantitative aspects, qualitative factors such as management principles, cost discipline and the creation of long-term added value play a significant role.

Strategy

Strategy

We assess your real estate portfolio, evaluate and create holistic and sustainable strategies and support you through the implementation process.

We facilitate strategic partnerships and generate synergies for additional development and value enhancement potential.

Networking

Networking

Thanks to many years of experience and the network we have built up as a result, synergies and connections are created between property owners, investors, asset managers and service providers.

With this approach, we built bridges between direct and indirect property investments, private and institutional investors as well as between French- and German-speaking Switzerland for our clients.

Mandates

Mandates

We develop a suitable real estate strategy for you on a mandate basis.

The continuous personal dialogue ensures the ability to respond to changing preferences or market situations at any time. This can also take the form of participation in bodies such as investment committees, boards of directors or trustees.

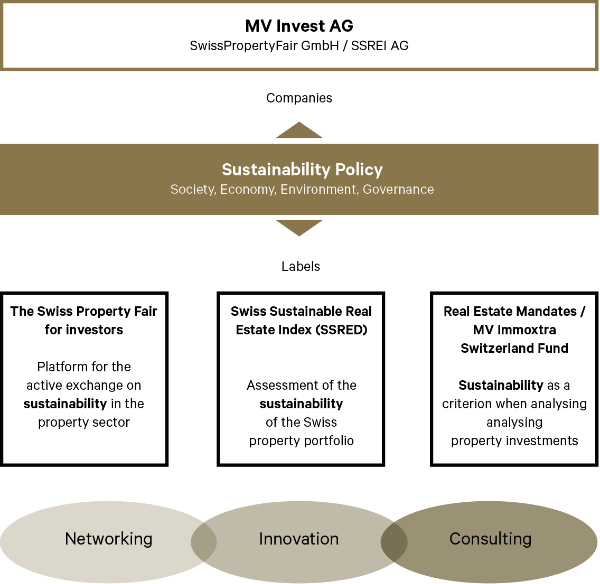

Sustainability

Sustainability

Our proprietary sustainability model allows us to evaluate all listed and non-listed Swiss real estate products (stocks, funds, investment foundations) and provide institutional investors with sustainability reporting.

With the Swiss Sustainable Real Estate Index (SSREI), a standard for assessing the sustainability of the Swiss building stock was launched as well.

Market Commentary April 2025

The past month was also marked by market disruptions triggered by U.S. tariff antics, affecting real estate stocks. While Swiss real estate equities experienced only a short-term but sharp setback in the REAL Index, real estate funds suffered for a longer period...

Market Commentary April 2025

The past month was also marked by market disruptions triggered by U.S. tariff antics, affecting real estate stocks. While Swiss real estate equities experienced only a short-term but sharp setback in the REAL Index, real estate funds suffered for a longer period. General uncertainty remains noticeable. On one hand, falling interest rates continue to support the sector, and dividends distributed in many cases are mostly reinvested. On the other hand, economic risks are dampening expectations in the commercial property sector. However, the Swiss franc as a safe haven is currently compensating well for these concerns. International investors continue to favor stable stocks such as Swiss Prime Site and PSP Swiss Property. But excesses carry risks with a dividend yield of 2.8% and a premium (agio) of up to 35%, conditions can shift quickly. Capital measures added pressure to the funds segment: a CHF 350 million capital increase by SIMA, along with other similar-sized issuances being announced. Demand for residential real estate remains high, additionally supported by low interest rates. In uncertain times, many asset managers are more likely to increase than reduce their allocations in indirect real estate investments. Fund and company results remain solid and have a stabilizing effect. However, the stock market is expected to remain jittery, with continued volatility. Precisely in such an environment, interesting opportunities and arbitrage situations regularly arise opportunities. Consolidation in the financial sector continues: insurance companies Helvetia and Baloise have announced a merger, and CHAM and INA have successfully combined into Cham Swiss Properties. In contrast, Switzerland’s largest real estate provider, UBS, made a last-minute decision not to merge UBS Direct Residential after all — a decision that leaves a bitter aftertaste. With a premium of 55%, caution is advised with this title, even though broader market indicators remain positive for the coming weeks...

The Market Commentary newsletter - subscribe here!

Market Commentary March 2025

Swiss real estate funds have closed an exceptionally volatile quarter. While the average performance of +1.9% may appear encouraging at first glance, it remains fragile given the challenging market environment...

Market Commentary March 2025

Swiss real estate funds have closed an exceptionally volatile quarter. While the average performance of +1.9% may appear encouraging at first glance, it remains fragile given the challenging market environment. Although past and potentially further interest rate cuts by the Swiss National Bank (SNB), along with high market liquidity, supports a positive environment for real estate investments for the coming months, listed real estate funds currently struggle to convince investors in a sustainable manner. This is reflected in a wide performance range of individual funds this quarter, spanning from -8% to +8%. Meanwhile, economic stimulus packages and increased defence spending have led to a noticeable rise in long-term interest rates across Europe. The yield spread between real estate funds and risk-free investments has now narrowed to less than 200 basis points, leaving uncertainty as to whether this is a temporary reaction or the beginning of a structural shift. What is clear, however, is that strong demand has driven prices of many funds to excessive levels, decoupling current developments from realistic long-term value potential. This perception is gradually being recognized in the market. The upward trend in the SWIIT Index, which tracks all listed Swiss real estate funds, has either stalled or significantly cooled in recent weeks. Following the challenging years of 2022 and 2023, many investors are reassessing their strategies. One often overlooked yet fundamentally strong segment is real estate equities with a residential share exceeding 50%. Despite frequent criticism over their low free float, these stocks offer stability. Data from recent years clearly show that active management has continuously generated value, whereas passive approaches have led to capital erosion.

The Market Commentary newsletter - subscribe here!

Market Commentary February 2025

Traditionally, February is a time of caution, as investors await the release of the first annual results of real estate stocks. However, political and economic issues are currently dominating the headlines...

Market Commentary February 2025

Traditionally, February is a time of caution, as investors await the release of the first annual results of real estate stocks. However, political and economic issues are currently dominating the headlines. In the U.S., the economy remains stable, but President Trump’s desire to lower interest rates while keeping inflation under control is proving challenging. One possible strategy to achieve this would be a reduction in oil prices, which could help ease inflation. At the same time, he is working to accelerate a resolution of the Ukraine conflict and secure access to raw materials— a strategic goal that major powers have always pursued to strengthen their global influence. Meanwhile, Europe is experiencing a phase of instability. The confirmation of a political shift to the right in Germany through recent elections came as no surprise. Political developments directly impact inflation, migration, and resource management— all critical factors for the real estate sector and investors. In Switzerland, investors are anticipating a possible return of negative interest rates. Unlike ten years ago, when this was considered unlikely, the Swiss National Bank is now openly discussing various possible scenarios. As a result, the gross yield on real estate purchases in cities has returned to the levels seen in 2020/2021, when the COVID crisis drove investors to acquire residential properties at inflated prices. In the real estate stock sector, Swiss Prime Site caused a surprise by announcing a capital increase with very short notice— just one hour before the market closed, an extremely unusual practice. The first annual results show that portfolio revaluations slightly exceeded expectations. The merger ratios between Ina Invest AG and Cham Group AG were published as expected, and the newly formed company, Cham Swiss Properties AG, shows potential— the internal management structure of Cham Group AG was adopted as a best practice.

The Market Commentary newsletter - subscribe here!

Our team for your goals.

Expertise, passion, and anticipation lay the foundation for us to fully focus on your needs

Roland Vögele

CEO

+41 43 499 24 90

Sacha Deutsch

Senior Advisor

+41 43 499 24 91

Ulrich Kaluscha

Senior Advisor

+41 43 499 24 96

Raphael Schuler

Client Relations Manager

+41 43 499 24 92

Remo Burri

Investment Analyst

+41 43 499 24 94

Leonie Eberhardt

Event/Marketing Manager

+41 43 499 24 89

Debora Zgraggen

Operations Manager

+41 43 499 24 97

Elodie Gadola

Event/Marketing Manager

+41 43 499 24 93

Elvira Bieri

Chief Sustainability Officer

CEO SSREI AG

+41 43 499 24 99